Australia’s only ASX listed vehicle providing investors with direct access to water

| ASX: D2O | NAV $1.51 |

|---|---|

| Change | Net Asset Value per Share as at 31 October 2024 |

| ASX: D2O | NAV $1.51 |

|---|---|

| Change | Net Asset Value per Share as at 31 October 2024 |

Through ownership and active management of a diversified portfolio of water assets, Duxton Water provides irrigators with a broad range of water supply solutions.

Structural shifts in productive demand for water, combined with the cap on supply, suggests water entitlements may experience further appreciation in value.

With an active management approach, the Company expects to provide investors with a bi-annual dividend and exposure to capital growth through the appreciation in value of the underlying water assets.

SQM Research rates Duxton Water 4 stars high investment grade

CURRENT MONTH

October 2024

NAV Per Share: $1.51

Total Water Assets: $366 million

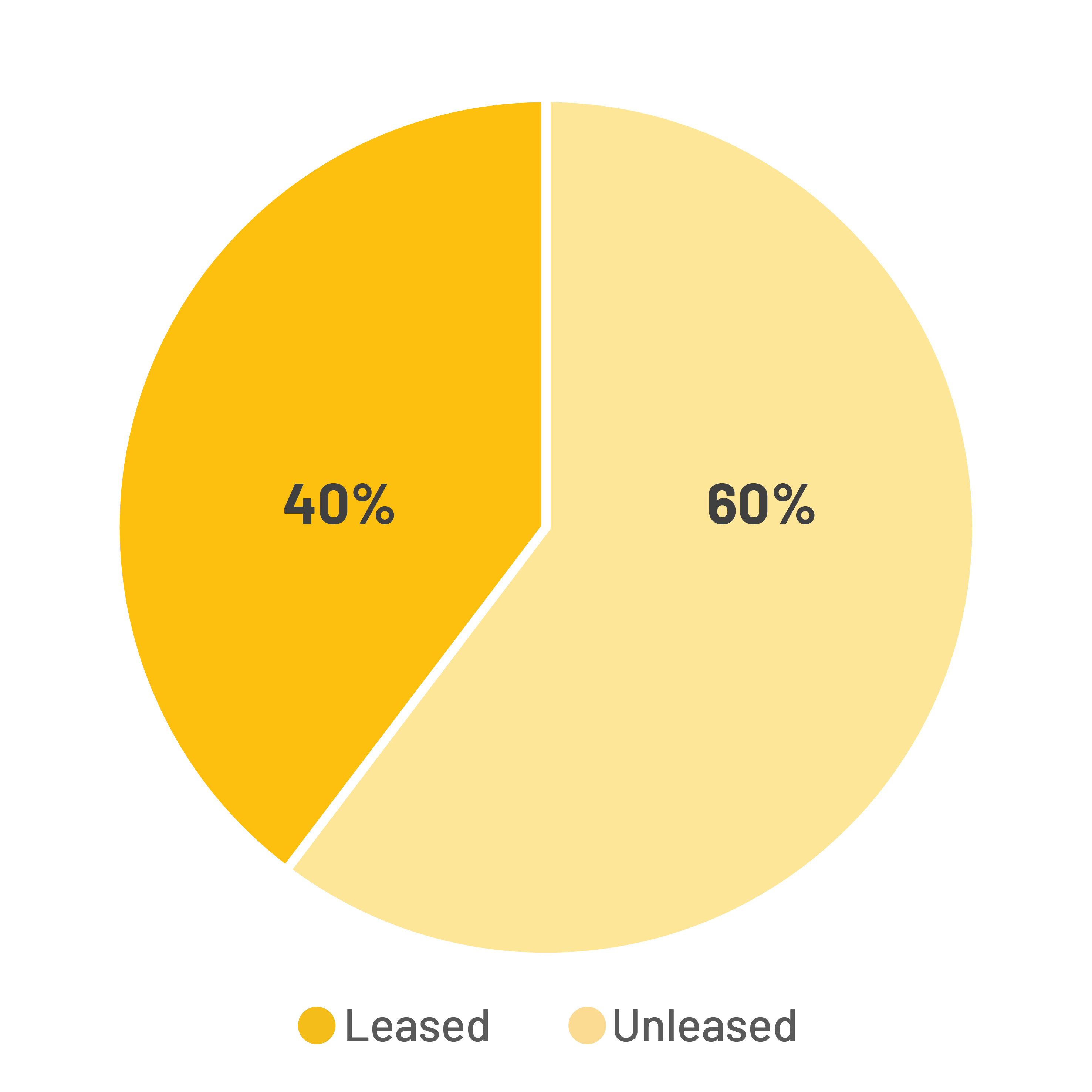

Entitlements Leased: 40%

As of 31 October 2024:

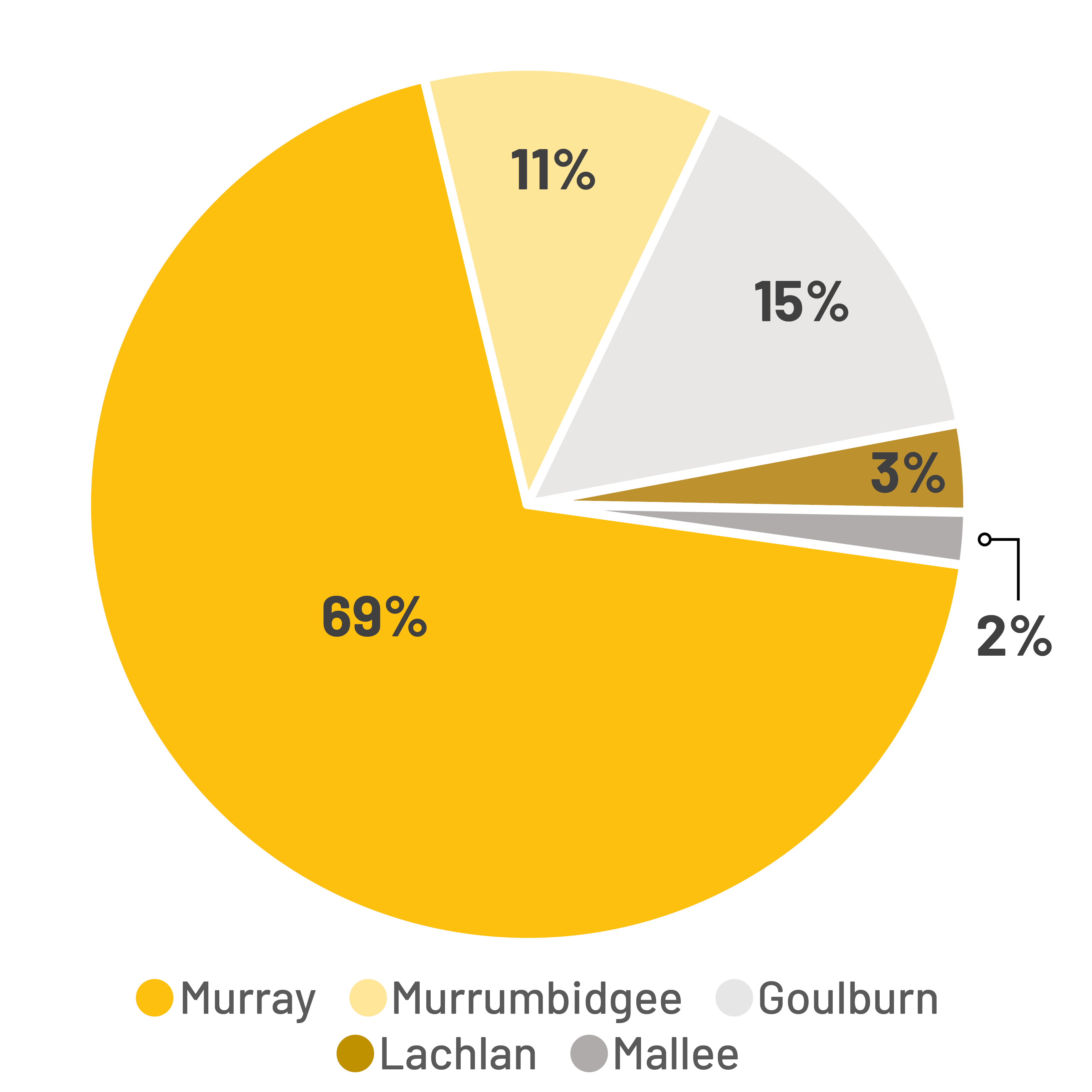

Entitlement Portfolio Value by Region

Water Portfolio Diversification

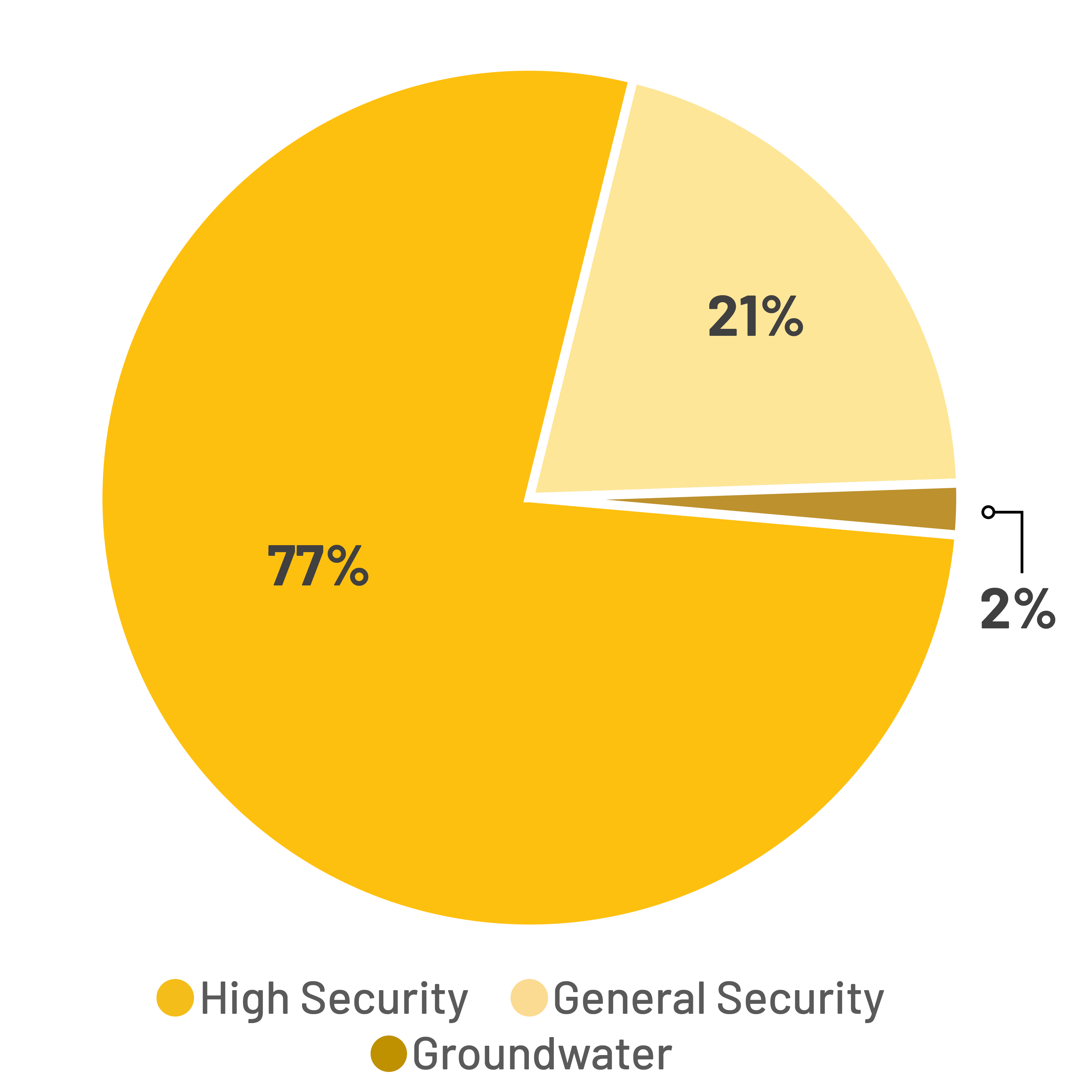

Water Security

Breakdown

The target for Duxton Water, is to have 70-80% of the entitlements in long-term leases with irrigators. This provides Duxton Water, and its shareholders, a visible, regular revenue stream, whilst providing the irrigator access to the resource with the same level of security that they would have if they owned it themselves without the capital cost.

The ‘unleased’ portion of the portfolio allows Duxton Water to receive and then actively manage the annual allocation water. This is traded in the spot market or forward contracted. The ‘unleased’ portion may achieve returns above that of the leased portion, but returns are expected to be more volatile year-to-year, as allocation volumes and prices are more variable and driven by shorter term trends.

The Company has an ability to optimise returns and minimise downside risk through the diversified portfolio and hedging opportunities. For example, some entitlements allow carryover from one year to the next. The Company can also enter into forward contracts, and own general security entitlements. These have a lower capital cost and in wet periods (when allocation prices are lower) will yield well with greater volume of allocation.

Video Highlights

Murray River at dusk

Chairman

• • • • • • • • • • • • • •Ed Peter is the co-founder and Chairman of Duxton Asset Management (“Duxton”). Prior to forming Duxton in 2009, Ed was Head of Deutsche Asset Management Asia Pacific (“DeAM Asia”), Middle East and North Africa. Ed has been exposed to the Australian water market since 1999.

Non-Executive Director

• • • • • • • • • • • • • •Stephen Duerden is the CEO of Duxton Asset Management. Stephen has over 26 years of experience in investment management and joined Duxton in May 2009. Prior to this, Stephen was the COO and Director for both the Complex Assets Investments Team and the Singapore operation of DeAM Asia.

Independent Non-Executive Director / Deputy Chair

• • • • • • • • • • • • • •Dirk Wiedmann has 28 years of experience in the finance industry. Over his career, Dirk has held senior global positions with several Banks, including UBS AG, Bank Julius Baer & Co Ltd and Rothschild Bank AG. Dirk has been investing in Australian agricultural businesses since 1999.

Independent Non-Executive Director

• • • • • • • • • • • • • •Dennis Mutton has a long history in the fields of natural resource management and primary industries. Dennis has also held roles as Commissioner and Deputy President of the Murray Darling Basin Commission and Chair of the SA Natural Resources Management Council.

Independent Non-Executive Director

• • • • • • • • • • • • • •Dr Vivienne Brand is a qualified lawyer who specialises in corporate law research, governance and ethics. Vivienne grew up in the Riverland on an irrigated fruit block and so has a personal understanding of, and interest in, the critical role access to water plays in supporting Australia’s agriculture.

Independent Non-Executive Director

• • • • • • • • • • • • • •Brendan Rinaldi has 17 years of experience in the finance industry and is currently the State General Manager of Victoria and Riverina for Elders. Before Elders, He was an executive at ANZ Banking Group, leading corporate and commercial lending teams in agribusiness and health. Brendan is a Governor of the American Chamber of Commerce, a Chartered Accountant, and holds a Bachelor of Commerce.

Company Secretary

• • • • • • • • • • • • • •Katelyn Adams has over 10 years of accounting and company secretarial experience, servicing predominantly ASX listed companies. Katelyn has extensive knowledge in company secretarial duties, ASX Listing Rule requirements, IPO and capital raising processes, as well as a strong technical accounting knowledge.